[URGENT- ACTION NEEDED] SSN Data Breaches: Essential Steps for All, Especially Sole Proprietors and Single-Member LLCs

In 2024, a series of significant Social Security Number (SSN) data breaches have raised serious concerns about the security of personal information. With millions of individuals potentially exposed to identity theft, the need for immediate and effective action has never been more critical. One of the most powerful steps you can take to protect yourself is freezing your credit. This article will guide you through the process, helping you secure your financial identity and prevent unauthorized access to your credit reports. Although most media has focused on the personal effect, the reality is data breaches also affect your business.

Understanding the Impact of the 2024 SSN Data Breaches

The 2024 SSN data breaches have affected a vast number of people, exposing sensitive information such as Social Security Numbers, addresses, and financial details. These breaches have left millions vulnerable to identity theft, where criminals use stolen information to open fraudulent accounts, take out loans, or engage in other illegal activities under someone else’s name.

If your SSN has been compromised, freezing your credit is a critical step in protecting yourself. A credit freeze, also known as a security freeze, restricts access to your credit report, making it much harder for identity thieves to open new accounts in your name.

The Unique Risks for Sole Proprietors and Single-Member LLCs

As a sole proprietor or single-member LLC, your personal and business finances are closely connected. Unlike larger businesses with separate legal identities, your business liabilities are directly tied to your personal credit. This means that if your personal information is compromised, your business could face severe financial risks, including unauthorized loans, fraudulent credit accounts, and damage to your credit score.

In light of the recent SSN data breaches, taking proactive measures to protect your credit is not just advisable—it’s essential. Freezing your credit is a powerful step that can prevent unauthorized access to your credit reports, safeguarding both your personal and business financial health.

Why Freezing Your Credit is Essential

When your credit is frozen, creditors cannot access your credit report without your permission. This means that even if a thief has your SSN and other personal information, they won’t be able to open new credit lines or loans in your name. A credit freeze does not affect your credit score or prevent you from using your existing credit accounts, but it does add an essential layer of security.

Given the scale of the 2024 data breaches, freezing your credit is not just a precaution—it’s a necessity for anyone whose information may have been exposed.

How Freezing Your Credit Protects Your Business

A credit freeze restricts access to your credit report, making it nearly impossible for identity thieves to open new accounts or lines of credit in your name. For business owners, this is particularly important because:

Protecting Business Credit: If a thief gains access to your personal information, they could potentially take out business loans or open credit lines using your business’s name. A credit freeze helps prevent this from happening.

Maintaining Creditworthiness: Your ability to secure financing for your business depends on your creditworthiness. A single fraudulent account or loan can damage your credit score, making it harder to obtain the credit you need for business growth.

Avoiding Legal and Financial Headaches: Dealing with identity theft is time-consuming and can be costly. As a business owner, your time is valuable, and managing the fallout from a breach can distract you from running your business.

What about your children & Minors?

Yes, you can freeze your child's credit file. To protect the identities of both you and your child who's under 18, complete the minor request form. There are certain forms of documentation you will need as part of this process.

You will need to provide copies of one of the following to verify your identity:

A copy of your driver's license or other government-issued identification

A copy of your Social Security card

A copy of your birth certificate

To validate your child's identity, you will need to provide copies of both of the following:

A copy of the child's Social Security card

A copy of the child's birth certificate

To prove you are the child's parent or authorized representative, you will need to provide copies of one of the following:

A copy of the child's birth certificate

A copy of a court order

A copy of a lawfully executed and valid power of attorney

A copy of a foster care certification

What is Refresh.me?

More than budgeting and investments - Managing your financial health means staying on top of your credit score, protecting your identity, and managing your online privacy. Sign up for Refresh.me!

Refresh.me is a comprehensive financial management app that helps you monitor your credit, track your expenses, and stay on top of your financial health. For business owners, especially those with sole proprietorships or single-member LLCs, Refresh.me offers several key benefits:

Credit Monitoring: Refreshme provides real-time credit monitoring, alerting you to any suspicious activity that could indicate identity theft. Receive daily alerts and updates from TransUnion, Experian, and Equifax - such as new accounts opened, balance changes, credit inquiries, and more.

Privacy Management: Refresh.me.me monitors data broker websites for your personal details like your name, address, and phone number - and remove your data if they find it.

Dark Web Monitoring: Receive alerts for suspicious address changes, high-risk transactions using your SSN, or if any of your personal information is found on the dark web.

Expense Tracking: Easily track both personal and business expenses, ensuring that your financial records are accurate and up-to-date.

Budget Management: Create and manage budgets for your business, helping you control costs and maximize profitability.

Alerts and Notifications: Receive alerts for important financial events, such as changes to your credit score or upcoming bill payments.

How to Freeze Your Credit with Major Credit Bureaus

DISCLAIMER:

You have the right to freeze your credit report, which stops others from accessing your credit information without your permission. This freeze helps protect you from someone else opening credit accounts in your name without your okay. But keep in mind, freezing your credit might slow down or stop you from getting approved for new loans, credit cards, or mortgages quickly when you need them.

If you don’t want to freeze your credit, you can also put a fraud alert on your credit file for free. A fraud alert lasts for one year and makes businesses verify your identity before giving you new credit. If you’ve been a victim of identity theft, you can get a longer fraud alert that lasts seven years.

A credit freeze doesn’t block companies you already have an account with from checking your credit report when they need to, like for increasing your credit limit or updating your account.

The three major credit bureaus—Experian, Equifax, and TransUnion—are the primary organizations that maintain credit reports in the United States. Freezing your credit with each of them is straightforward and free of charge.

What Happens if I need to use my Credit to apply for anything?

You will log into your accounts with the bureaus below and temporarily lift the freeze! Having a freeze on your credit report also shows a great sign of financial self-control. It shows that you are intentional with your credit, not abusing it yourself while trying to prevent others from doing the same.

If you need to use your credit while it's frozen, you'll need to temporarily lift the freeze. Here’s how it works:

Temporary Lift: You can unfreeze your credit for a specific period or for a specific creditor. This allows you to apply for loans, credit cards, or other credit services.

How to Lift the Freeze: You can lift the freeze by contacting the credit bureau(s) where your credit is frozen (Experian, Equifax, TransUnion). You’ll need the PIN or password you received when you first froze your credit.

Timing: Lifting a freeze usually happens quickly, often within minutes if you request it online or by phone. However, it’s a good idea to plan ahead if you know you’ll need to apply for credit.

Re-freezing: After you’re done applying for credit, you can re-freeze your credit to keep it secure.

1.1 Experian

Website: Experian Security Freeze

Steps:

Visit the Website: Go to the Experian Security Freeze page.

Start the Freeze: Click on “Add a Security Freeze.”

Create or Log In to Your Account: If you don’t have an account, create one. If you do, log in.

Verify Your Identity: You may need to answer security questions or provide documentation.

Complete the Freeze: Once your identity is confirmed, your credit will be frozen. You’ll receive a PIN or password to lift the freeze in the future. SAVE THIS PIN IN A SECURE PLACE

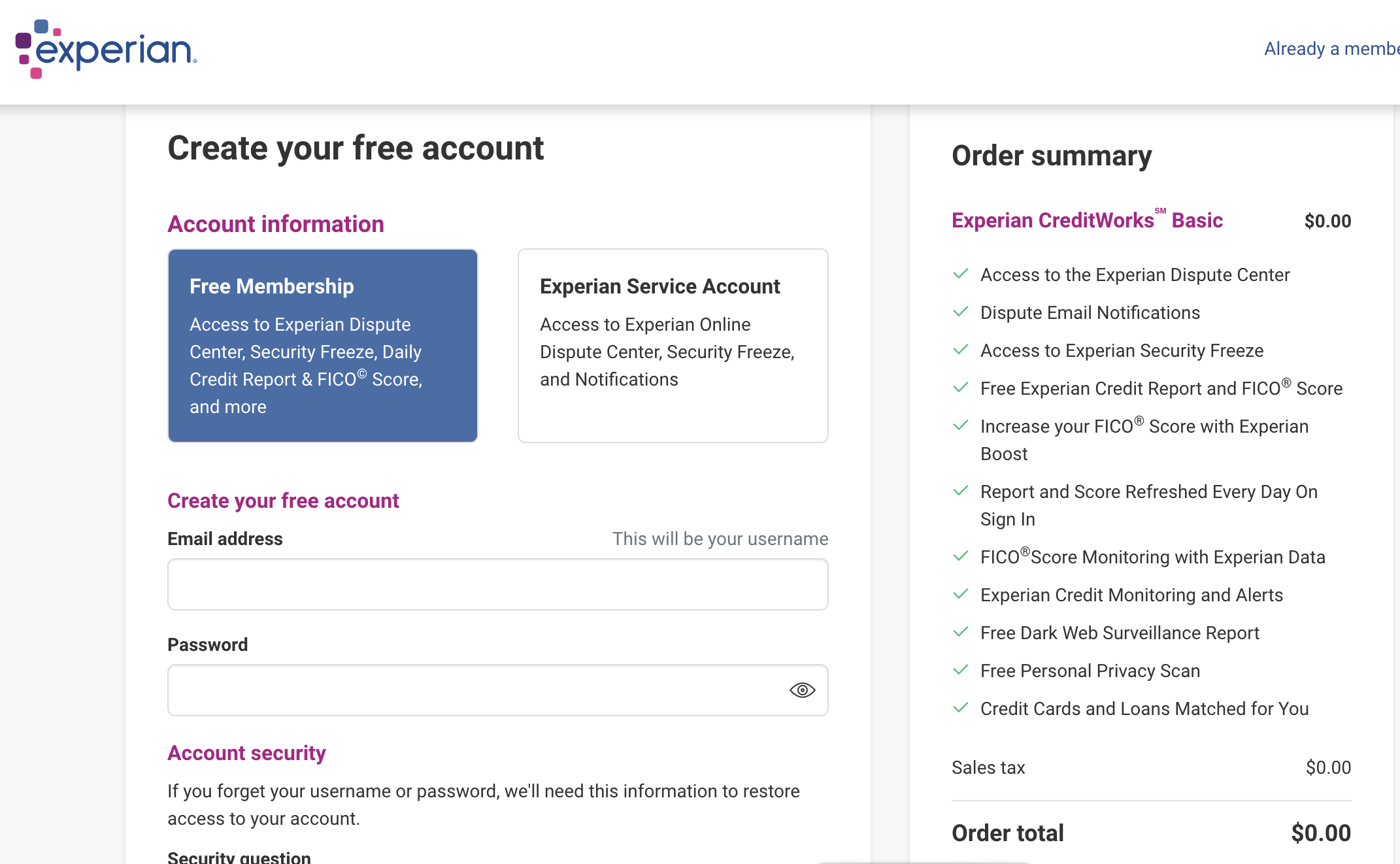

Once your identity is verified you will be taken to this screen. Remember, you can do this for free, therefore your checkout total should be $0.00

Your Experian checkout screen

At the end you will see the current status - You can also upgrade with "Identity Theft Insurance". You will want to review very carefully the stipulations and understand ahead of time the course of action needed for you to receive your payout, forbid a breach should happen.

1.2 Equifax

Website: Equifax Security Freeze

Steps:

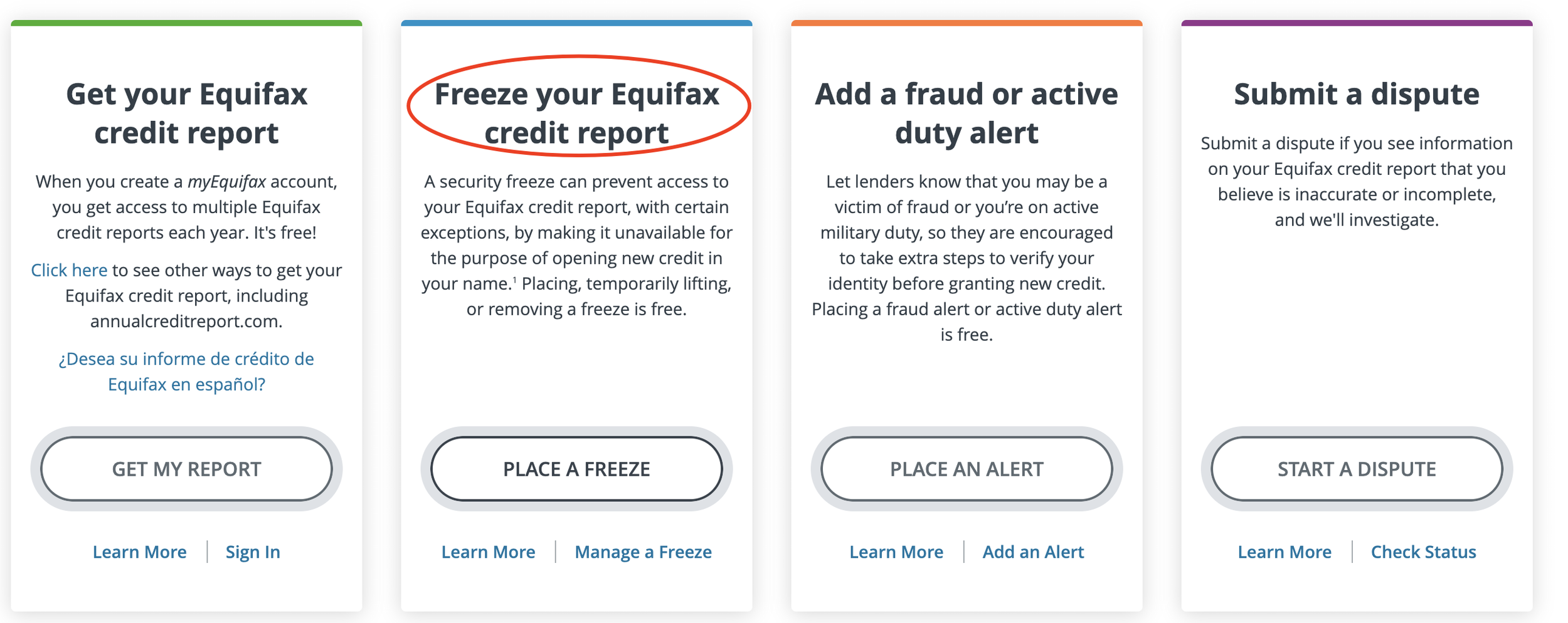

Access the Equifax Page: Go to the Equifax Security Freeze page.

Select Freeze Option: Choose “Place or Manage a Freeze.”

Create or Log In to Your myEquifax Account: Create an account if needed, or log in if you have one.

Identity Verification: Answer security questions to confirm your identity.

Place the Freeze: Follow the prompts to freeze your credit. A confirmation will be provided, with details on lifting the freeze later.

Once you complete the form with Equifax providing your private information, you must verify at the end, a bit different from Experian, don't worry.

Once complete you will reach the final status page. You can come back to this page when logging into your account to "unfreeze" if need be. We did notice Equifax no longer uses the PIN process, incase you feel you missed a step and start looking for it.

1.3 TransUnion

Website: TransUnion Security Freeze

Steps:

Go to the TransUnion Freeze Page: Visit the TransUnion Security Freeze page.

Initiate Freeze: Click on “Add Freeze” or “Manage Freeze.”

Log In or Create an Account: If you don’t have an account, create one; otherwise, log in.

Verify Your Identity: Provide the necessary information to verify your identity.

Freeze Confirmation: You’ll receive a one-time PIN to finalize the account and freeze.

This will be most likely the start page for Transunion (at the time of this article)

How to Freeze Your Credit with Specialized Credit Bureaus

In addition to the three major credit bureaus, there are specialized bureaus that maintain different types of consumer data. Freezing your credit with these organizations adds an extra layer of protection.

2.1 Innovis

Website: Innovis Security Freeze

Steps:

Visit the Innovis Freeze Page: Go to the Innovis Security Freeze page.

Start the Freeze: Click on “Add a Security Freeze.”

Provide Personal Information: Enter the details required to verify your identity.

Complete the Freeze: Finish the process and you’ll receive confirmation and instructions on managing the freeze.

At the end you will see this confirmation page. You will also notice, Innovis will be sending you a confirmation letter via U.S. mail.

2.2 ChexSystems

ChexSystems is very important and different because this is the platform that also tracks and holds information about evictions, owned property management, and medical bills!

Website: ChexSystems Security Freeze

This part may look confusing. You are being asked if you are freezing for yourself or behalf of someone else. In our case presently you will jump up top to register yourself. If on behalf of someone else you will click the options and it will show you how to request by phone or mail.

Steps:

Go to the ChexSystems Freeze Page: Visit the ChexSystems Security Freeze page.

Place the Freeze: Click on “Place a Security Freeze.”

Enter Your Information: Provide the necessary details for identity verification.

Confirmation: Once completed, your freeze will be active, and you’ll receive confirmation.

Your registration form will be shown and should look like this at the time of this article

You will need to complete the form immediately or you will run into a timeout issue when you submit the form and will have to complete again. (Sidenote: When this happened as you can see we were not told the error, but of course we were writing this article, so it did timeout.)

ChexSystems - Identity Protection Questions, are a series of questions about perhaps where you have lived, people you may know, etc. Answer to the best of your memory.

ChexSystems - Registration Completion page. You can choose to receive all via portal with emails sent or via mail. We would suggest via portal incase you are on vacation, away for any reasons, etc.

Tip: When inputting your ID number, if you receive an error message, try inputting your ID number without the dashes. If you are in the military, when choosing state, choose “MY”. You also do not have to list all previous addresses at the bottom of the page in order to complete.

You should see a confirmation of your registration for ChexSystems ... then the final step we came here for.

Final Step: Log in with your new information to place the actual “Security Freeze”

Use the drop down to choose "Place A Freeze"

Press continue to FREEZE

ChexSystems - Final Security Freeze Confirmation Window

Steps:

Access the NCTUE Site: Visit the NCTUE Security Freeze page.

Call the Freeze Line: Dial 1-866-349-5355 to use their automated system.

Follow the Prompts: Follow the instructions to place a freeze on your NCTUE account.

Complete the Process: You will receive confirmation and instructions for managing the freeze.

Click to place your Nctue freeze!

Nctue - Confirmation page + Download and or Print your confirmation ASAP

2.4 LexisNexis

Website: LexisNexis Security Freeze

Steps:

Visit LexisNexis Freeze Page: Go to the LexisNexis Security Freeze page.

Request a Freeze: Click on “Request a Security Freeze.”

Fill Out the Form: Complete the form with your personal information.

Submit the Request: Finalize the request, and your freeze will be placed. You’ll receive details on how to lift the freeze if necessary.

Tip: If you do not have an up-to-date/current ID showing your current address, you can select and use the categories for alternate methods of verifying your identity.

LexisNexis confirmation page. With LexisNexis, you will receive your PIN via mail. When it comes keep it in a safe and secure page with all of your completed information to have on hand.

Additional Measures for Protecting Your Identity

While freezing your credit is a powerful tool, there are other steps you should consider to protect your financial identity:

Monitor Your Credit Reports: Regularly review your credit reports for any suspicious activity. You can obtain a free credit report annually from each bureau through AnnualCreditReport.com.

Consider a Fraud Alert: If you’re not ready to freeze your credit, consider placing a fraud alert on your credit reports. This is free and alerts creditors to verify your identity before opening new accounts.

Secure Your Online Accounts: Use strong, unique passwords for your financial accounts and enable two-factor authentication where possible.

How Refresh.me Complements Your Credit Freeze?

Even after freezing your credit, it’s essential to monitor your financial activities closely. Refresh.me’s real-time alerts and monitoring features ensure that you’re always informed about your financial status, allowing you to act quickly if any issues arise. This is especially important for business owners who need to maintain a strong credit profile to secure financing and grow their businesses.

Act Now to Protect Your Financial Identity

The 2024 SSN data breaches have exposed millions of individuals to potential identity theft. Freezing your credit is a vital step in safeguarding your personal information and preventing criminals from opening accounts in your name. By following the steps outlined in this guide, you can secure your financial identity and reduce the risk of fraud. Don’t wait—take action today to protect yourself and your financial future.